Performance surety bonds are a critical component in the construction and contracting industries, serving as a financial guarantee that a contractor will fulfill their obligations as outlined in a contract. These bonds are often required by project owners, especially in public works and large-scale private projects, to ensure that the project will be completed according to the agreed-upon terms. In the event that the contractor fails to perform, the bond provides financial compensation to the project owner, which can be used to hire another contractor to complete the work. This security mechanism is vital in managing risks and ensuring that projects are delivered on time and within budget.

How Performance Surety Bonds Work

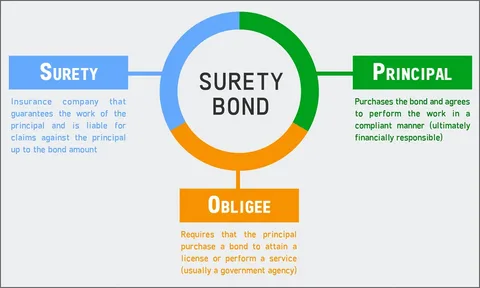

The process of obtaining a performance surety bond involves three parties: the obligee, the principal, and the surety. The obligee is the project owner who requires the bond, the principal is the contractor who must obtain the bond, and the surety is the bonding company that provides the bond. When a contractor fails to meet the contract terms, the obligee can make a claim on the bond. The surety company will then investigate the claim, and if it is found to be valid, the surety will compensate the obligee up to the bond’s value. The principal is then responsible for repaying the surety, ensuring that the financial burden ultimately falls on the contractor who failed to deliver.

Benefits of Performance Surety Bonds

Performance surety bonds offer numerous benefits to both project owners and contractors. For project owners, these bonds provide peace of mind, knowing that their projects have a financial safety net in case of contractor default. This ensures that projects can continue without significant delays or additional costs. For contractors, obtaining a performance bond can enhance their reputation and competitiveness in the market, as it demonstrates their financial stability and commitment to fulfilling contractual obligations. Additionally, the existence of a bond can lead to more favorable contract terms, as project owners may be more willing to work with bonded contractors.

The Cost and Requirements of Performance Surety Bonds

The cost of a performance surety bond varies based on several factors, including the size and complexity of the project, the contractor’s financial standing, and the bond amount. Typically, the cost ranges from 1% to 3% of the bond amount. Contractors must meet specific requirements to qualify for a bond, such as demonstrating a strong financial history, a good credit score, and relevant experience in the industry. Surety companies also assess the contractor’s ability to perform the work as specified in the contract. Meeting these requirements is essential for contractors to secure the bond and successfully bid on projects that require it.